Calculate my equity

Find out how much equity you may be able to access from your home loan. How to calculate your home equity.

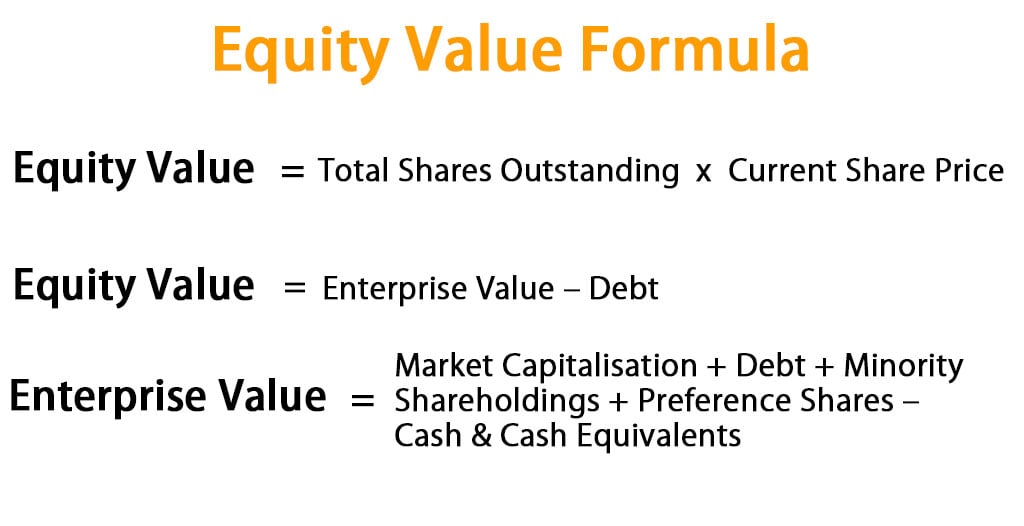

Equity Formula Definition How To Calculate Total Equity

Put Your Home Equity To Work Pay For Big Expenses.

. You take your homes value and subtract the balance of any mortgages or loans. Lenders that allow a combined loan-to-value ratio of 80 may. For example if your current balance is 100000 and your homes market value is.

Costs 0 To See Savings. In this case the home equity percentage is 22 55000 250000 22. Enter your loans interest rate.

Ad Compare Top home Equity Lenders. Home equity is built by paying down your mortgage and by what happens to the value of your home. Find The Best Home Equity Mortgage Companies.

This tool can show you how much equity you have in your home. That the property you are leveraging is an owner-occupier home rather than an investment property. You can deduct the mortgage from the homes value to.

Use the Equation. Apply Today Get Low Rates. To figure out how much equity you have in your home subtract the amount you owe on all loans secured by your house from its appraised value.

Apply For Home Equity And Enjoy Low Rates. Ad Todays Best Home Equity Rates. Available Home Equity at 100.

Our equity calculator will show the value of your property that you have unlocked less your remaining mortgage balance. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. No Home Equity Loan.

If your 500000 home increases in value to 600000 your equity with a 400000. Next you will need to estimate the value at which you. Apply Now Find a Cheaper Way of Borrowing Cash.

Ad Call for a refi instead. Whatever Your Investing Goals Are We Have the Tools to Get You Started. The equity and leverage calculator makes some underlying assumptions.

Calculating your house equity is really simple. On the other hand we can also calculate equity by using the following steps. Costs 0 To See Savings.

Ad Monthly Payment Calculations. Ad Trusted Way To Calculate Your House Payment In 3 Mins. Apply online for conditional approval fill out the form as best as you can it can take around 20 minutes.

Up to 10 cash back A home equity line of credit also called a HELOC is a loan in the form of a line of credit. If you divide 100000 by 200000 you get 050 which means you have a 50 loan-to-value ratio and 50 equity. You can also divide home equity by the market value to determine your home equity percentage.

Home equity is the difference between the homes market value and the remaining mortgage balance. Tap Your Home Equity Without the Burden of Additional Debt. Compare Mortgage Payment Options.

It is calculated by. This is the annual interest rate youll pay on the loan. If your home is appraised at a value lower.

Equity is the portion of a propertys value that an individual owns outright. Refinance While Rates Are Still Low. Use this simple home equity calculator to estimate how much equity you have in your.

In the second text box. Get Pre Approved In 24hrs. Use this calculator to see how much you may be eligible to borrow.

To calculate your homes equity divide your current mortgage balance by your homes market value. Ad Use LendingTrees Marketplace To Find The Best Home Equity Loan Option For You. Home Equity Line of Credit Balance.

Your lender will calculate 80 of the value of the property 80 of 800000 is 640000. Available Home Equity at 80. How much equity you can borrow depends on a variety of factors starting with the type of loan.

Higher loan-to-value requirements can result in larger home equity loans or lines. In the first text box enter the aproximate value of your house. Ad No Monthly Payments.

If you own at least 20 of your home an LTV of 80 or less youll probably qualify for a home equity loan depending on. The first information youll need to gather to calculate your equity multiple is the total money invested into the property. Dont Settle For Just One Offer Compare Home Equity Rates And Find Your Lowest Instantly.

Standard lenders typically allow you to use up to 80 of your homes equity. Refinance While Rates Are Still Low. Ad Trusted Way To Calculate Your House Payment In 3 Mins.

This means your usable equity would be calculated as 640000 80 property value minus. Use our equity calculator tool by entering 2 simple numbers. It is also important to remember that home equity fluctuates depending on current market conditions.

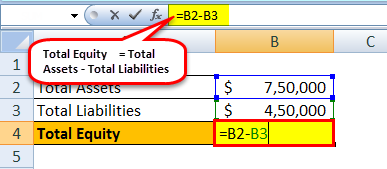

The size of a home equity loan or line of credit will also depend on the loan-to-value requirements of the lender. Calculating your home equity is a simple process. Finally we calculate equity by deducting the total liabilities from the total assets.

The tool will immediately calculate your current loan-to-value ratio. If conditionally approved find your property and make. Home equity loan rates are between 35 and 925 on average.

Put Your Home Equity To Work Pay For Big Expenses. HELOCs allow homeowners to borrow funds using the equity in their homes as.

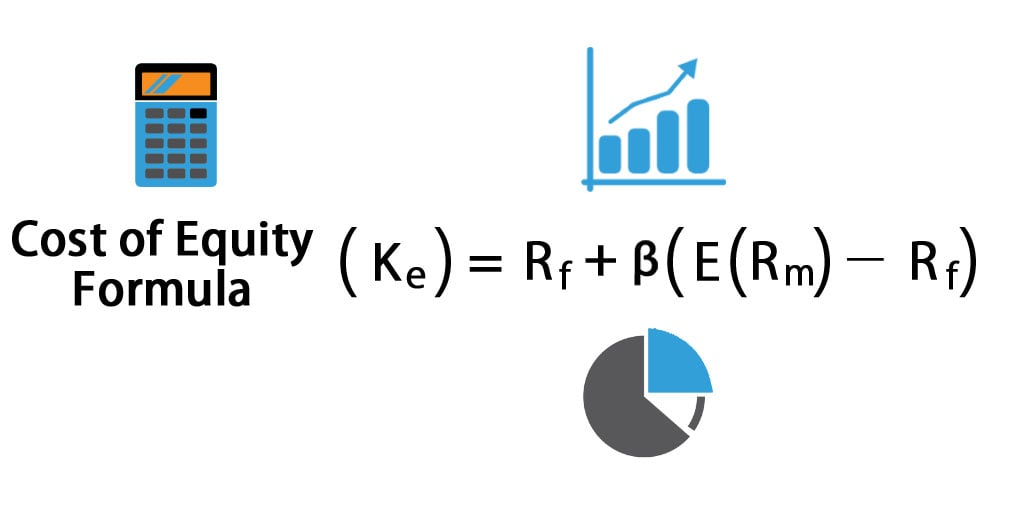

Cost Of Equity Formula Calculator Excel Template

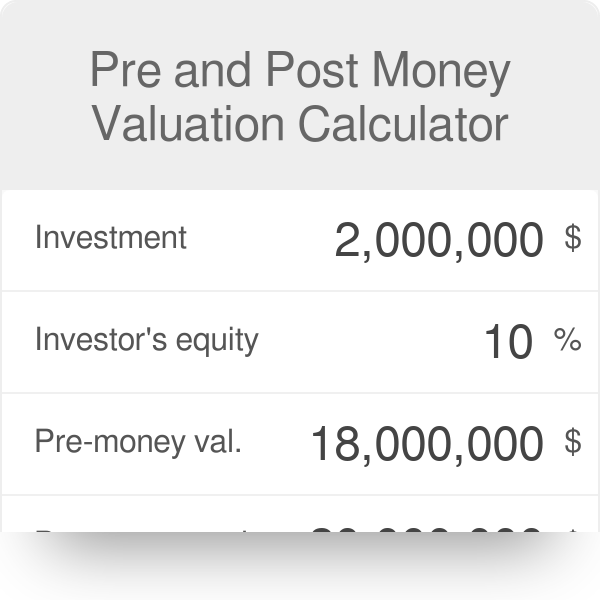

Startup Valuation Calculator Investment Equity Post And Pre Money

Home Equity Loan Calculator Nerdwallet

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Return On Equity Roe Calculation And What It Means

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Owner S Equity Definition Formula Examples Calculations

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

:max_bytes(150000):strip_icc():gifv()/equity_final-da21918a6af144f39c6cd36c22397437.jpg)

Equity For Shareholders How It Works And How To Calculate It

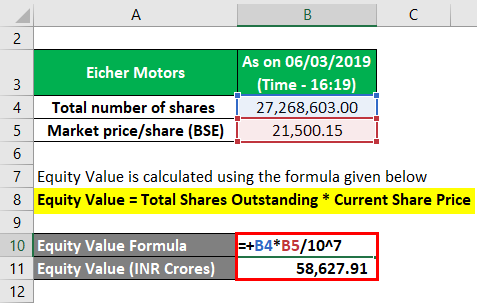

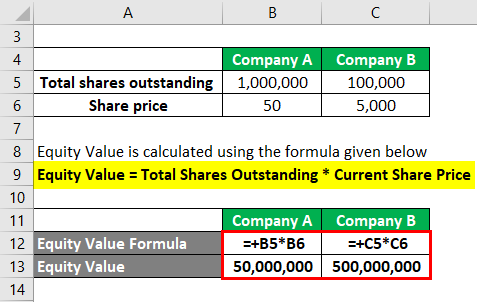

Equity Value Formula Calculator Excel Template

Equity Formula Definition How To Calculate Total Equity

Equity Value Formula Calculator Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Equity Value Formula Calculator Excel Template

How Do You Calculate The Debt To Equity Ratio

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium