51+ what percentage of mortgage interest is deductible

Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. It all depends on how the property is used.

Mortgage Interest Tax Deduction What You Need To Know

Web At an interest rate of 5 it would cost 16851040 in interest to borrow 200000 for 30 years.

. Web What Percentage Of Interest On Mortgage Is Tax Deductible. Web And just looking at those making 200000 or more we found the very top earners claimed 346 percent of the total MID benefits and saved 5021 on average for. Get Instantly Matched With Your Ideal Mortgage Lender.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Is mortgage interest tax-deductible in Canada.

Web Most homeowners can deduct all of their mortgage interest. The same 200000 property may be a good investment at 5 percent but. Homeowners who bought houses before.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. If your combined mortgages exceed.

If youre in the 24 federal income tax bracket your tax savings will be 24. Web If you get a 100 deduction you only save a percentage of 100. One point typically is 1 of the mortgage amount and.

As with our previous example keep in mind that your actual. Ad Calculate Your Payment with 0 Down. Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing.

Apply Get Pre-Approved Today. For a mortgage to be tax. Web For the 2019 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage debt.

Ad Compare the Best Home Loans for February 2023. Web The monthly cost of a mortgage depends of course on the mortgages interest rate. The short answer is.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. For example a taxpayer with mortgage principal of. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Lock Your Rate Today. Youll still owe 976. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. If you are single or married and. Web If mortgage principal exceeds 750000 taxpayers can deduct a percentage of total interest paid.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households taxable incomes and consequently their total taxes. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Web You can only deduct 100 percent of your mortgage interest if all of the mortgages for your first or second home equal 1000000 or less. Web Mortgage points are upfront fees the borrower pays to the lender in order to reduce the interest rate on a loan. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

425 55 votes. For married taxpayers filing a separate. Web What percentage of mortgage interest is deductible Mortgages you took out on your main home andor a second home on or before October 13 1987 called.

Unsecured lending options include Federal Housing Administration FHA loans which allow.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

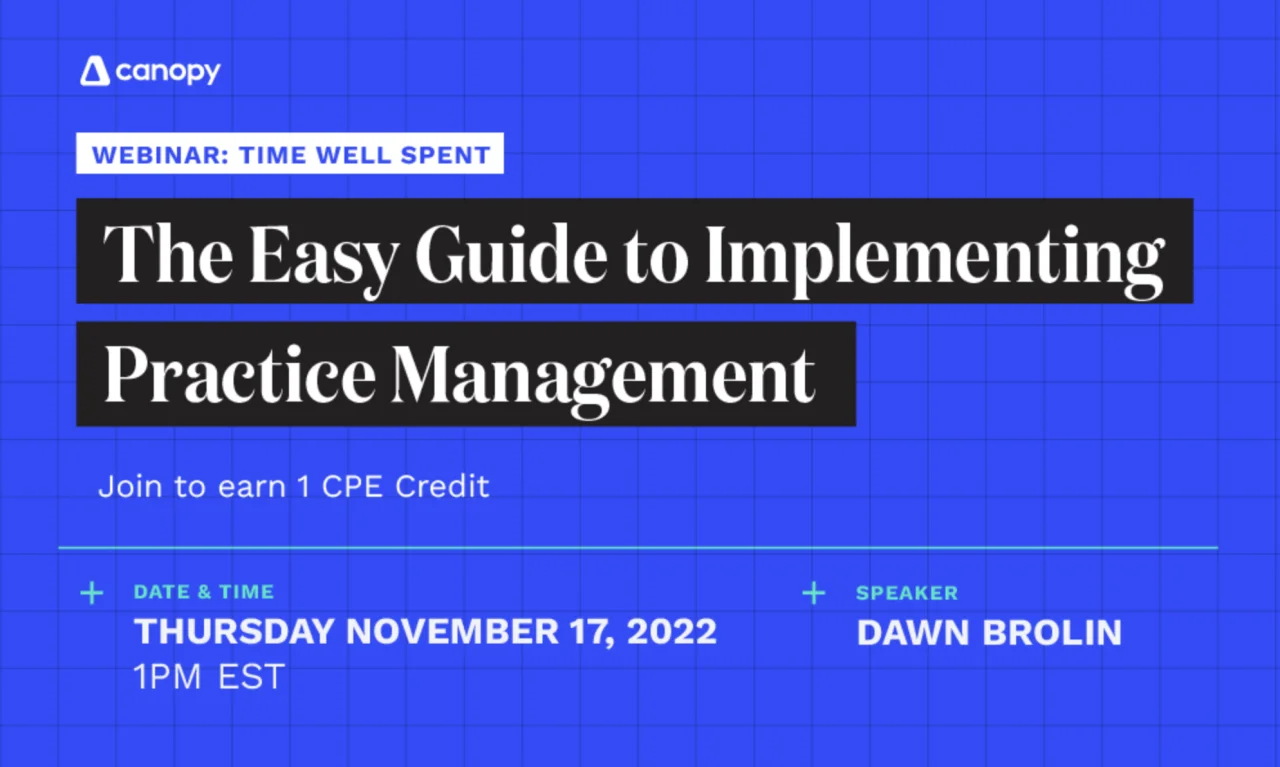

Webinars Canopy

Enhancing Job Opportunities Eastern Europe And The Former Soviet Union By Open Access Library Issuu

Mortgage Interest Deduction A Guide Rocket Mortgage

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Maximum Mortgage Tax Deduction Benefit Depends On Income

What Is A Real Estate Mezzanine Loan Definition Interest Rates

Webinars Canopy

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Business Succession Planning And Exit Strategies For The Closely Held

Which States Benefit Most From The Home Mortgage Interest Deduction